Forms you may receive:

You will receive a Form 1095-A if you or someone in your household had qualifying coverage through Access Health CT. If someone in your household had HUSKY Health (Medicaid or Children’s Health Insurance Plan (CHIP)) coverage in the previous plan year, they can request a form called a Form 1095-B from the Connecticut Department of Social Services (DSS). You should expect a Form 1095-C if you had coverage through your employer or through Medicare. If you have questions, please contact your employer or the Centers for Medicare and Medicaid Services (CMS).

NOTE: Form 1095-B is NO LONGER REQUIRED by federal law when preparing federal income tax returns and it will not be mailed to you automatically. However, DSS is required to make Form 1095-B available upon request and consumers who need a copy of the Form can request it in one of the following ways:

- Online: portal.ct.gov/ctdss1095B

- By Phone: HUSKY Health 1095-B Information Center, 1-844-503-6871 (Mon. to Fri., 8 a.m. to 5 p.m.),

- Mail a request to: The HUSKY Health 1095-B Information Center, P.O. Box 280747, East Hartford, CT 06128-0747

Next steps after you receive Form 1095-A:

- Check the information on your Form 1095-A. Make sure the information is up to date for everyone covered under your health plan, including names, home address, health plan information and Advance Premium Tax Credit amounts (if applicable). If any of the information on Form 1095-A is wrong, please call us at1-855-396-2428 (If you are deaf or hearing impaired, you may use the TTY at 1-855-789-2428 or contact us at 1-855-396-2428 with a relay operator).

- To view your Form 1095-A online, sign in to your Access Health CT account. You may need to reset your password if it’s been a while since you logged in.

- If you are locked out of your online account or if you need to create one, you must call us at 1-855-396-2428(If you are deaf or hearing impaired, you may use the TTY at 1-855-789-2428 or contact us at 1-855-396-2428 with a relay operator).

- If you have questions about your Form 1095-A, or if you believe there is an error on your Form, please call us right away.

Important things to keep in mind about filing your taxes:

If you received Advance Premium Tax Credits (APTCs) in the previous plan year and you do not file your tax return with IRS Form 8962 to reconcile your APTCs, you may not be able to receive APTCs in future years until you complete Form 8962 and file it with your federal income tax return. If your filing or income information has changed since you applied for health coverage, you may have to pay back some or all of the Advance Premium Tax Credit amounts (financial help) you received. Form 1095-A CANNOT be emailed or faxed. If you’ve misplaced your Form 1095-A, please contact our call center for assistance.

Frequently Asked Questions

1. Why do I need this information?

You need it to complete IRS Form 8962 as part of your federal income tax return, which the IRS uses to determine whether you received the correct amount of Advance Premium Tax Credits (financial help). Form 8962 can be downloaded at irs.gov. Please see a tax professional for help with completing Form 8962.

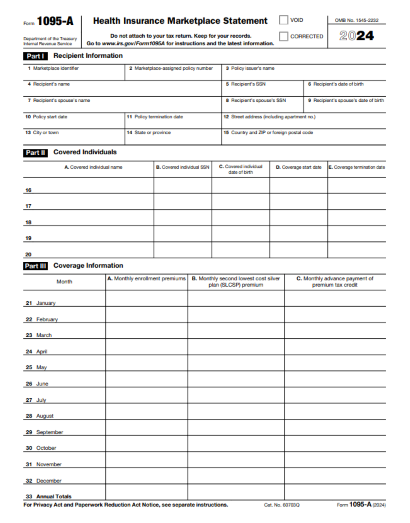

Form 1095-A shows:

- Who had qualified coverage in your household

- Your household plan information and monthly payment (known as a premium)

- The amount of money paid to your insurance company to help lower your monthly costs (known as Advance Premium Tax Credits or APTCs)

2. What should I do if my tax return was rejected for a missing Form 8962?

If you filed your federal tax return electronically and it was rejected for a missing Form 8962, you may need to resubmit your federal tax return with a completed Form 8962 or an explanation for why you are missing the Form, and then attach it to the federal return when you refile. Learn how to fix it and correctly file electronically

3. I received financial help in the previous plan year. Should I file taxes?

YES. You must file a federal income tax return for the previous plan year, even if you usually don’t file or your income is below the level requiring you to file.

4. Could I pay a penalty?

It depends.

- For the previous tax year, the penalty or fee for not having health insurance coverage is $0.

- For tax years 2018 and earlier, individuals without coverage during those years may be subject to a penalty.

5. Why does my monthly payment (known as premium) amount on my Form 1095-A NOT match the premium amount on the bill I receive from my insurance company every month?

- The premium amount in Column A of your Form 1095-A may show an amount different than what you paid all year because amounts in Column A show only the portion of your premium that covers Essential Health Benefits.

- Plans sold through the Exchange are required to cover Essential Health Benefits.

- Insurance companies may offer benefits in addition to the Essential Health Benefits, so the premium paid may be different than the amount listed in Column A to cover these additional benefits.

6. Where is my form?

- Sign in to your Access Health CT account

- Click “Get My Tax Forms”

- Download/View your Form 1095-A

We’re here to help! If you can’t find your Form 1095-A in your account inbox, click on “Read My Messages” and then search for “1095” in the search bar, or call 1-855-396-2428 (TTY users should call 1-855-789-2428 or contact us at 1-855-396-2428 with a relay operator).

Don’t have an online account? Click HERE to get started.

7. Additional Resources

- Second Lowest Cost Silver Plan Rates – 2024

- Second Lowest Cost Silver Plan Rates – 2023

- Second Lowest Cost Silver Plan Rates – 2022

- Second Lowest Cost Silver Plan Rates – 2021

- Lowest Cost Bronze Plan Rates – 2024

- Lowest Cost Bronze Plan Rates – 2023

- Lowest Cost Bronze Plan Rates – 2022

- Lowest Cost Bronze Plan Rates – 2021

Latest from the blog

How to get the most out of your preventive screenings at no extra cost to you

Taking care of your health is important. One way to stay healthy is by getting regular checkups and screenings. Many preventive screenings are covered at no cost when you have health insurance through Access Health CT (AHCT). Here’s how to make the most of these...

Moving to Connecticut? Here’s How to Enroll in Health and Dental Coverage through Access Health CT

If you’re moving to Connecticut and you don’t have health or dental coverage, or if you’re unsatisfied with your current coverage, you may qualify for health and dental coverage through Access Health CT (AHCT). AHCT is the state’s official health insurance...

How to Report Life Changes to Access Health CT and Why It’s Important

Life can change in many ways. You might have a change in income (how much money your household makes), get married or have a baby. When these things happen, it’s important to tell Access Health CT (AHCT) right away. Reporting life changes will help you get the right...

Navigating health coverage when you’re self-employed: A guide to Access Health CT options

Being self-employed means you can set your own schedule and be your own boss. But it also means that you may need to find your own health or dental coverage. Access Health CT (AHCT) is here to help you get the coverage you need.Understanding coverage If you’re...

How and why you need to verify your personal information with Access Health CT

When you apply for health coverage through Access Health CT (AHCT), we might ask you to provide certain documents to verify your personal information. These are called verification documents. They help us check important information like your household income,...

Look for Form 1095-A from Access Health CT to file your Federal Income Tax Return

Tax season is here. If you were enrolled in health insurance through Access Health CT (AHCT) last year, you’ll need Form 1095-A to file your federal income tax return. This Form has details about your health plan and any financial help you received. Keep it safe, just...