Tax season is here. If you were enrolled in health insurance through Access Health CT (AHCT) last year, you’ll need Form 1095-A to file your federal income tax return. This Form has details about your health plan and any financial help you received. Keep it safe, just like your W-2 or other tax documents.

What is Form 1095-A?

Form 1095-A is a statement from Access Health CT that shows:

- Who in your household had a health plan.

- How long they had coverage.

- The monthly cost of the plan.

- Any financial help (called Advance Premium Tax Credits) that lowered your health plan premiums.

Even if you only had a plan for part of the year or didn’t receive financial help, you still need this Form to file your federal income tax return.

When and how will you get your Form?

You should get Form 1095-A in the mail from Access Health CT by late January or early February. If you don’t receive it by the third week of February, check your online account or contact us for help.

Some people get more than one Form 1095-A. This can happen if:

- You changed health plans during the year.

- You added or removed a family member from your plan.

- A family member passed away, but others stayed enrolled.

How to read your Form 1095-A

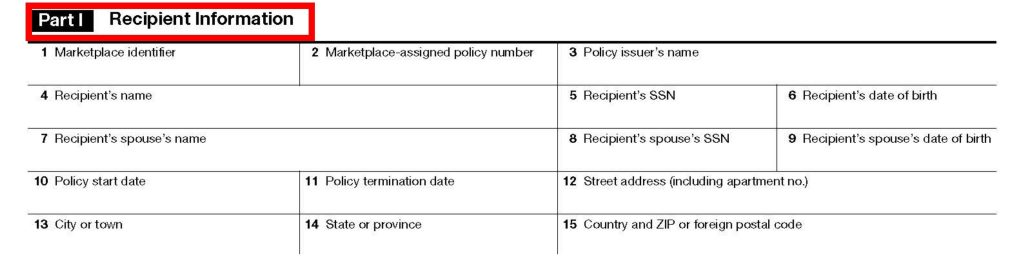

Your Form has three parts:

- This part lists your name, address, Social Security number and policy details. If you’re married, your spouse’s information is also included.

- A helpful tip is to check boxes 10 and 11 to make sure your coverage start and end dates are correct. If they’re wrong, contact us.

- This part lists everyone in your household who had coverage under your plan, including a spouse, partner or children.

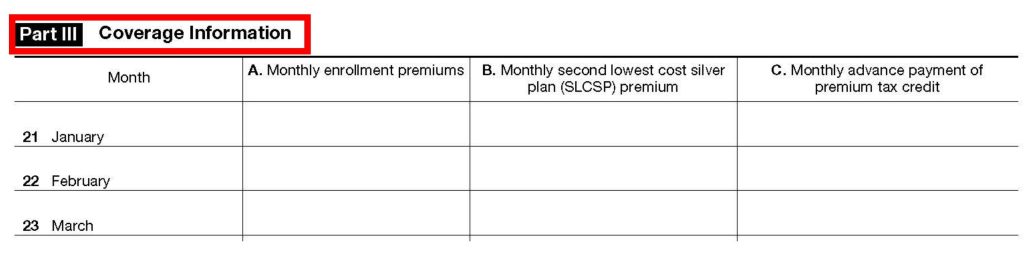

- This part shows the full cost of your plan and how much financial help (APTC) was sent to your insurance company to lower your monthly payments.

- Review these numbers carefully. If something looks off, contact us at 1-855-805-4325 to correct any mistakes.

If the amount in Column A of your Form looks lower than what you paid, that’s okay. It only includes costs for the 10 Essential Health Benefits (EHBs), which include preventive services, hospital stays and prescriptions. Insurance companies may offer benefits in addition to the 10 Essential Health Benefits, so the premium paid may be different than the amount listed in Column A to cover these additional benefits.

What to do next

Review your Form:

- Check all details for accuracy, especially dates and amounts. If anything looks wrong, or if you have any questions, reach out to Access Health CT.

Keep It Safe:

- Keep Form 1095-A with your tax documents. You’ll need it to complete the Internal Revenue Service (IRS) Form 8962 when filing your federal income tax return. The IRS uses Form 8962 to determine if you received the correct amount of APTCs. If you received APTCs and do not file your federal income tax return with Form 8962 to reconcile your APTC amounts, you may not be able to receive APTCs in future years until you complete Form 8962 and file it with your federal income tax return.

Ask for Help:

- If you don’t get your Form or notice a mistake, contact Access Health CT as soon as possible.

Who doesn’t get Form 1095-A?

Not everyone receives this Form. You won’t get Form 1095-A if you:

- Had a Catastrophic health plan.

- Were covered by HUSKY Health/Medicaid.

Need help?

If you have questions about Form 1095-A, need a copy, or think something is wrong, we are ready to help. Reach out as soon as possible to avoid delays when filing your federal income tax return.

Still have questions?

Whether you have questions about your eligibility, comparing plans, or want to see if you qualify for financial help, our team is ready and available to assist you. Remember, all help is free!

- Online: AccessHealthCT.com/get-help/

- Live chat: AccessHealthCT.com; click “Live Chat” icon

- Phone: 1-855-805-4325; customers who are deaf or hearing impaired may use TTY at 1-855-789-2428 or call with a relay operator (we speak over 100 languages).

- Find a Certified Broker near you who can recommend health and dental coverage that is right for your needs and budget.